RCM Tip #9: Focus on Your Outstanding A/R

Is your ophthalmology practice leaving hard-earned revenue on the table?

As an ophthalmologist you are trained to check and monitor your patient’s eyesight, but are you also keeping an eye on the financial health of your practice?

In a perfect world, you would get paid for every bill sent, but unfortunately that is not reality. With the rise in high deductible health plans, it’s becoming more challenging to collect payment, and rising A/R is a growing concern. Between unpaid medical claims and outstanding patient balances, US physicians are leaving $125 billion on the table each year.1

Can you afford to walk away from this hard-earned revenue? For most ophthalmologists, the answer is no. But where do you start? This month’s ophthalmology revenue cycle tip will focus on how to manage your outstanding A/R to improve your practice’s collections and cash flow.

What is A/R?

Accounts receivable, or A/R, is the outstanding amount you are owed for the services you have performed and billed for.

A/R should include:

- Bills to patients

- Insurance payers

- Any other revenue sources

A/R should exclude any discounts or credits. A high A/R amount indicates that a large chunk of your hard work is going unpaid. Keep A/R as low as possible to ensure you are getting paid in a timely and consistent manner. Taking time to understand your A/R and how it trends over time can tell you a lot about the health of your ophthalmology revenue cycle.

How do I measure my A/R?

You can’t fix problems you don’t know about, so learning how to measure and analyze your A/R is the first step in managing it to help uncover potential areas of improvement in your ophthalmology revenue cycle.

You can’t fix problems you don’t know about, so learning how to measure and analyze your A/R is the first step in managing it to help uncover potential areas of improvement in your ophthalmology revenue cycle.

Days in A/R

A common metric is days in A/R, which tells you how long it takes to get paid on average. To calculate this, you’ll need to know your current outstanding A/R, as well as your average daily charges for your practice. Depending on your practice’s operations, you can average your daily charges over the previous 3-12 months. Then, you simply divide your total outstanding A/R by the average daily charges.

For example, if your ophthalmology practice posts an average of $5,000 in clinical charges a day and it has $175,000 in A/R, the days in A/R would be 35 days. This means that it takes 35 days on average for a claim to be paid. The lower the number, the faster you obtain payment.

Aging A/R

Days in A/R is a good place to start, but you should also dive a little deeper and break down your A/R by time period of outstanding balances by bill date, also known as aging buckets:

- 0-30 days

- 31-60 days

- 61-90 days

- 91-120 days

- 120 days +

You should measure the amount in each of these aging buckets as a percent of your overall practice A/R. It should be fairly consistent across the aging buckets. An increase in A/R from one time period to another may indicate that you have issues in your revenue cycle.

For example, a larger portion of A/R in the 0-30 days bucket may mean your practice is not as diligently collecting patients’ financial responsibility upfront. Medical claims not paid within 90 days could run into timely filing deadlines and you risk losing out on that revenue for good. It’s no surprise that the longer balances go unpaid, the more difficult it becomes to collect any payment at all.

What is a “good” A/R?

Now that you’ve figured out your practice’s A/R metrics, you should see how they compare to industry standard benchmarks.

According to the Medical Group Management Association (MGMA), a range of 40-50 days in A/R indicates your practice is functioning efficiently and doing very well, with an average of 45 days or less being ideal. A range of 50-60 days in A/R suggests there may be some room for improvement, and an average of 70+ days in A/R may mean there is significant room for improvement. When looking at A/R by age buckets, the goal is to keep your A/R greater than 90 days within the 12%-15% rage.2

Referencing these industry benchmarks can help you keep an eye on the overall financial health of your practice.

How do I tackle my A/R?

Your A/R changes every day and it’s important to stay on top of it to make sure you are getting paid for the service you have provided. Ideally, you should go after 100 percent of your outstanding balances, because after all you should get paid fairly for the work you put in. With your time and attention focused on taking care of patients and not paperwork, you may need to be more strategic about managing your A/R.

Your A/R changes every day and it’s important to stay on top of it to make sure you are getting paid for the service you have provided. Ideally, you should go after 100 percent of your outstanding balances, because after all you should get paid fairly for the work you put in. With your time and attention focused on taking care of patients and not paperwork, you may need to be more strategic about managing your A/R.

1. Focus on larger balances.

You could easily spin your wheels chasing down every dollar, spending more on collecting efforts than what you recover. Determine if there is a minimum dollar amount that makes it worthwhile to pursue. You may want to send statements to patients with balances less than $20, but not spend additional time calling and eventually just write off small balances. You should be aware that larger balances may be more difficult to obtain, especially if they are the patient’s responsibility. For larger patient balances, you may want to consider creating a payment plan with the patient or even accepting partial payment.

2. Take care of the low hanging fruit first.

Prioritize outstanding claims and balances by those that are easiest to recover. You may want to start with medical claims that have less complicated issues that your staff can quickly address, like incorrect patient or provider information, requests for additional documentation or incorrect codes.

3. Tackle A/R by payer.

Look for trends in unpaid claims, such as certain denied or excluded codes, or procedures that require prior authorization or referral documentation. And you can streamline your efforts by handling multiple outstanding medical claims in a single call with the insurance payer representative.

Whichever method you choose to work down your A/R, you should keep in mind any trends you uncover or lessons you learn along the way. Take the time to retrain your office and billing staff on any best ophthalmology billing practices that can be applied earlier in the revenue cycle that can help speed up collections.

How Integrated Technology and Professional Ophthalmology Billing Services Can Help

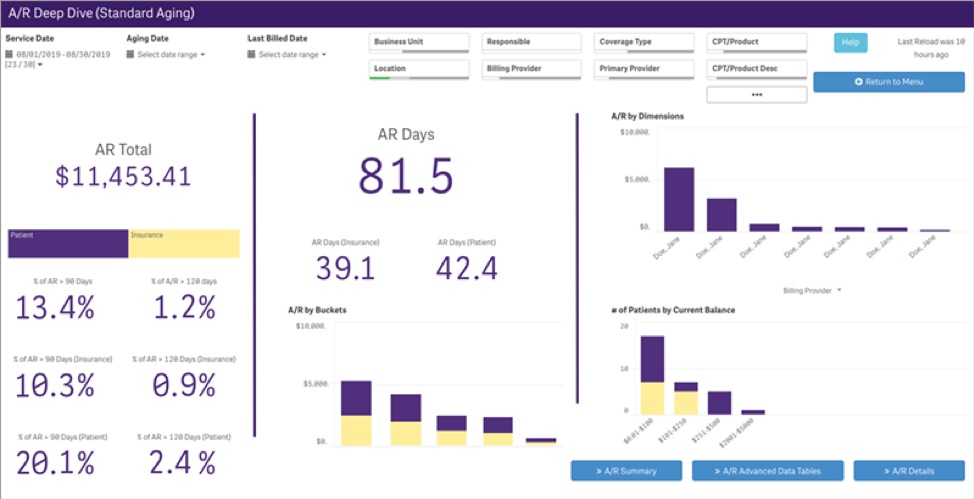

Your A/R is constantly evolving, so measuring, analyzing and working your A/R must be done consistently to help maintain your practice’s cash flow. Ideally, you should perform a weekly analysis of your collection backlog and a monthly deep dive of your A/R, so it doesn’t continue to grow.

Some practices even hire additional billing staff to manage A/R full time. But for many smaller practices, physician and staff time and resources are divided among patient care and daily administrative tasks, with limited bandwidth to focus on long term financial success. If this is your reality, call in some professional assistance to help manage your ophthalmology practice’s revenue cycle.

How Modernizing Medicine® Can Help With Your Ophthalmology Billing and Beyond

Our modmed® BOOST solution combines practice management technology and advanced ophthalmology billing and collections services to help address the operational and financial aspects of your practice. Since it seamlessly integrates with our EHR system, EMA®, modmed BOOST provides a single solution for your entire practice, cutting down on redundant data entry and expensive bridges.

Here are some features of our ophthalmology Practice Management system that can help you and your staff improve your billing workflow and stay on top of outstanding A/R:

- Automated insurance eligibility verification checks patient benefits and financial responsibility to help facilitate collections upfront

- Clear patient balance information empowers front office staff to collect patient payments at check-in and checkout.

- Advanced analytics reporting and dashboards allow you to easily monitor outstanding A/R by age, with the ability to filter by a variety of parameters, such as service date, bill date, payer, and many more.

With modmed BOOST, dedicated ophthalmology billing specialists help manage not only your A/R, but also claims processing, denial and rejection resolution and assistance with patient collections. The modmed BOOST team works diligently to help you collect what you are owed.

With modmed BOOST, dedicated ophthalmology billing specialists help manage not only your A/R, but also claims processing, denial and rejection resolution and assistance with patient collections. The modmed BOOST team works diligently to help you collect what you are owed.

For practices that struggle with patient collections, we even offer patient statements, outbound patient collection calls, an inbound billing hotline and patient payment processing. Working directly in your practice management system, the modmed BOOST team manages your billing process while allowing you to maintain visibility over your practice’s finances.

Going beyond daily billing tasks, the team monitors changes in medical billing rules and regulations, and works with you to develop ophthalmology billing processes to help speed up your revenue cycle and collect more of what you are owed.

- Medical Billing. Healthcare and Business Technology.

- Feltenberger GS, Gans DN. Benchmarking Success: The Essential Guide for Medical Practice Managers. 2nd Edition. MGMA. 2017