RCM Tip #10: Understand and Improve Your Net Collection Ratio

Is your gastroenterology practice collecting what you are owed?

For a gastroenterologist and practice owner like you, it’s critical to track a variety of medical billing performance metrics that can help correlate your top-line revenue to your bottom-line income.

While your staff may look at the number of patient appointments or overall charges as one measurement, there are other financial metrics that tell a more meaningful story about the health of your practice. Knowing your volume of charges is not enough, and it can be misleading if you’re not looking specifically at your collections.

Some gastroenterology practices add more physicians, patients and work hours to increase charges and revenue, yet don’t achieve collections commensurate with the additional activity. Even though more money is coming in, you may be working harder with less profitability.

This month’s revenue cycle management tip will focus on understanding and improving your net collection ratio to help you optimize your gastroenterology billing process and collect more of what you are owed.

What is net collections ratio?

Net collection ratio is a calculation of how much you are collecting compared to your allowed charges, indicating whether or not you are being paid successfully for your services rendered. The higher your net collection ratio, the more you are collecting of services that you have billed for. Understanding this key metric and keeping tabs on it over time can help you monitor the long term financial health of your gastroenterology practice.

How is net collection ratio calculated?

Spending some time digging into your financials and doing a deep analysis of your performance is one of the only ways to know how your practice is truly performing and where there may be room for improvement.

There are a few slightly different ways to calculate net collection ratio, but a widely used formula is as follows.

Net Collection Ratio = Total Collections/Net Charges (total charges – contractual adjustments) x 100

It’s important to note that net charges should factor in an insurance payer’s contractual adjustments to charges. For example, if you normally charge $200 for a procedure, but your contractual allowable rate with the insurance payer is $150, then the amount used to calculate your net collection ratio is the $150 allowable rate. Why? Because your fee schedule should be set above the highest allowed amount from your top payer to appropriately maximize your reimbursement revenue, meaning you will never collect 100% of your overall charges.

Using your net collection ratio instead of gross collection helps you focus on how effective you are in collecting money owed to your practice.

You can calculate your net collection ratio over a set period of time like 90 or 120 days, or you can match payments with the originating charges. Whichever method you choose, you should assess a time period far enough back that most claims will be closed or cleared, otherwise you will be including claims still in progress and your net collection ratio may seem alarmingly low.

What should my net collection ratio be?

Now that you’ve crunched the numbers and figured out your net collection ratio you should compare your practice’s performance to the industry standard benchmark.

According to the Medical Group Management Association (MGMA), a net collection ratio of 96%-99% indicates that your practice is functioning efficiently and doing very well. A net collection ratio of 93%-95% suggests there may be some room for improvement, and a 92% or less may mean there is significant room for improvement.1

How do I improve my net collection ratio?

If your net collection ratio is at or above the 96% benchmark, then your medical billing department is doing a good job. You may not need to make any changes to your current gastroenterology billing process, just simply monitor your net collection ratio going forward.

However, if you find that your net collection ratio is lower than expected, you may need to do some more digging to diagnose exactly what’s going awry in your billing process. Here are three different areas to look into further.

1. Denied Claims

Some denied claims are normal, but a high denial rate indicates a disconnect between your gastroenterology practice and your top insurance payers. Analyze the reason codes on your denials and look for any common trends like coding errors or missing documentation that can be resolved and corrected moving forward. You should also note any trends by payer, like excluded codes or preauthorization requirements for certain procedures.

2. Patient Collections

It’s no secret that patient out-of-pocket costs continue to increase and medical practices of all specialties find that a larger portion of its revenue comes from patients’ responsibility. If you have a larger portion of your patient balances outstanding, you may need to implement a more proactive approach to collecting patient balances in the office. You may also need to look into your patient statement policy to make sure it effectively communicates the amount due and how payment can be made.

3. Outstanding Claims

A long delay in payment of your claims can significantly slow down the cash flow for your practice. Follow up on outstanding claims to address any issues with the payers. The longer a claim goes without being paid, generally the more difficult it becomes to collect reimbursement.. Medical claims not paid within 90 days could result in timely filing deadlines, meaning you could miss out on that revenue for good. You may need to dedicate staff resources to regularly following up on outstanding claims to ensure you are paid timely for your hard work.

How Modernizing Medicine® Gastroenterology can help manage your gastroenterology billing

Net collection ratio is just one of the many financial metrics you should calculate and trend to make sure your practice has adequate and consistent cash flow to support your future growth. Some practices have medical billing and accounting staff dedicated to performing financial analysis and implementing gastroenterology billing process improvements. However, many practices rely on their physicians and clinical staff to juggle patient care along with administrative and medical billing tasks. If you struggle to find the time to adequately focus on financial analysis and long-term planning, you should consider enlisting the help of a professional gastroenterology billing service to manage your practice’s revenue cycle.

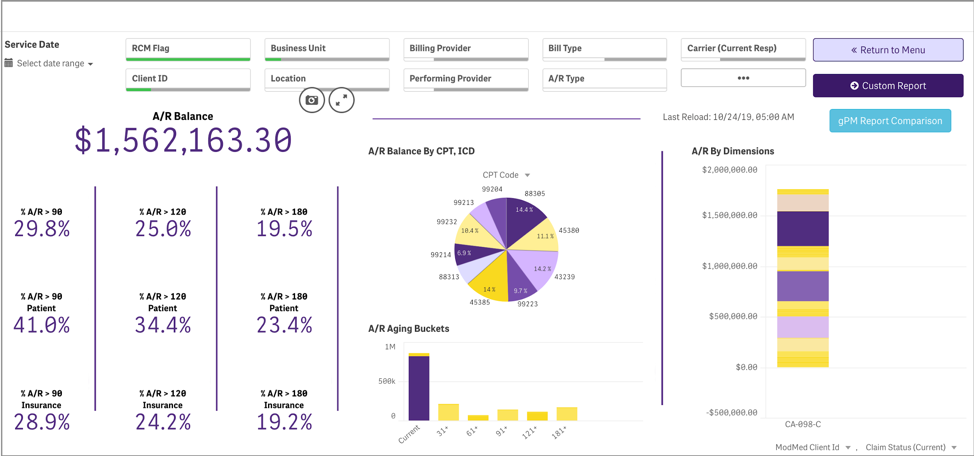

Our modmed®gBOOST solution combines innovative gastroenterology practice management technology and comprehensive business operations services to help address the operational and financial needs of your practice.

Our gastroenterology practice management system, gPM™, seamlessly integrates with our gGastro® EHR and ERW, to more efficiently connect your front and back offices. Tailored specifically for a gastroenterology workflow, gPM streamlines scheduling, patient intake, office flow and medical billing.

Here are some highlights of our gPM system that can help streamline your gastroenterology billing process:

- Simplify patient collections with clear patient balance information, patient statements and payment plans.

- Analyze your practice’s financial health with built-in tools for month-end reporting, claims management, accounts receivable and more.

- Advanced claims scrubbing technology to help catch costly errors and prevent rejections and denials.

To complete our all-in-one modmed gBOOST solution, our Business Operations Services provides comprehensive billing and collections management. Our experienced gastroenterology billing specialists are dedicated to help you process claims, manage rejections and denials, work down A/R and much more. By working within your practice’s gPM system and documenting each step, our gBOOST solution allows you to maintain visibility and control over your practice’s financials.

As part of our high-touch service, our client advisors meet with you monthly to review your financial health metrics and work with you to address any issues in your revenue cycle. Net collection ratio is one of the many key financial metrics that our client advisors monitor, benchmarking to industry standards and analyzing your billing process for opportunities for improvement.

From the beginning to the end of your revenue cycle, our easy-to-use, integrated technology and professional gastroenterology billing specialists are there to support your success and growth.

Here’s what some of our clients shared about modmed gBOOST

“Although we were hesitant in outsourcing our billing, as I am very hands on with the process, Modernizing Medicine Gastroenterology has exceeded any expectations I have had regarding their understanding, experience and reliability. The modmed gBOOST team I have been assigned took the time to understand our practice workflow and created streamlines to increase revenue.” – Jamie Flores, Nurse Manager, Douglas E. Wright, MD

“modmed gBOOST has been instrumental in helping improve our practice workflow and collections. Their attention to detail and dedication has helped our practice obtain optimum efficiency, and we cannot imagine running our practice without their services.” – Roger Kao, MD, Digestive Care Medical Center and Digestive Care Associates

- Feltenberger GS, Gans DN. Benchmarking Success: The Essential Guide for Medical Practice Managers. 2nd Edition. MGMA. 2017