Financing a New Medical Practice

Make start-up and operating budgets that consider cash flow, credit, capital and insurance

Financing your new practice starts with a strategic plan. Describe your mission, vision, values, goals, and the objectives and activities needed to achieve them.

Budget. Make a start-up budget for consulting, legal, accounting and other one-time costs. Make an operating budget to project revenue, expenses and key performance indicators. Update your budgets when you get new data.

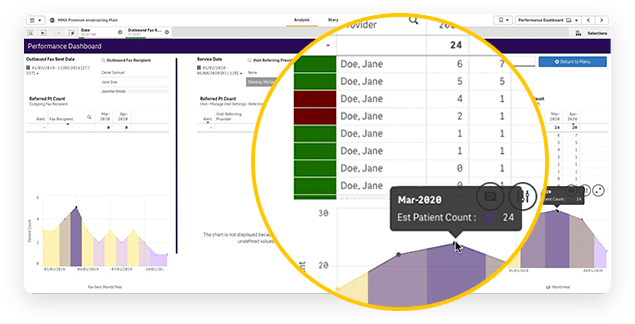

Cash Flow. Plan for expansions, dips in volume, lags in reimbursements, write-offs, disasters and other events that may affect cash flow. Consider software and systems that help you with billing and analytics.

Starting. To get a running start, consider buying into an existing practice or taking over from a retiring physician in your specialty.

Credit. You may want to pay off any med school debt before borrowing for a practice. If you don’t have $100,000 ready to invest and another $100,000 in a line of credit, develop a relationship with a bank that has medical experience. Shop multiple banks and remember the US Small Business Administration, which backs loans for practices.

Capital. Request only what you need, since a conservative request has a better chance of approval. Put off state-of-the-art gadgets, consider buying equipment used, and look for other ways to reduce capital needs. For example, an online platform for electronic health records and practice management software can save you the expenses of a server in your office.

Insurance. Policies range from coverages you may want to coverages you really need:

- Malpractice insurance helps protect you against lawsuits alleging negligence.

- Liability insurance helps protect against claims for injuries on your property.

- Contents insurance reimburses you for theft or damage to property.

- Business interruption insurance replaces income lost to disasters.

- Health insurance covers you and your employees for medical expenses.

- Disability insurance covers employees for loss of income from illness or injury.

- Life insurance pays beneficiaries in case an employee dies.

- Workers’ compensation helps employees who get injured or sick on the job.

- An employee fidelity bond helps protect the firm against misdeeds by staff.

- Corporate insurance helps protect against unforeseen circumstances.

- An umbrella policy covers you against lawsuits for damages or injury.

More in This Blog Series

Locating a New Medical Practice

Staffing and Tools for Your Practice

Sources

ModMed 2022 Patient Experience Report: What Patients Really Think, ModMed research report (2022 July)

“Checklist for New Practice Start Up,” MGMA Health Care Consulting Group (2000)

“New Practice Start-Up Checklist,” Kareo (2020)

R. Rohit Dhir, “5 Things I Wish I Knew Before I Started My Career in Urology,” The Scope of Practice blog (2021 January 21)

This blog is intended for informational purposes only and does not constitute legal or medical advice. Please consult with your legal counsel and other qualified advisors to ensure compliance with applicable laws, regulations and standards.